Speaker Johnson endorses bipartisan tax bill as ‘conservative,’ ‘pro-growth’ reform

House Speaker Mike Johnson, R-La., is coming out in support of a bipartisan tax deal scheduled for a vote later on Wednesday.

“The Tax Relief for American Families and Workers Act is important bipartisan legislation to revive conservative pro-growth tax reform,” Johnson said in a statement. “Crucially, the bill also ends a wasteful COVID-era program, saving taxpayers tens of billions of dollars.”

“Chairman Smith deserves great credit for bringing this bipartisan bill through committee with a strong vote of confidence, and for marking up related bills under regular order earlier in this Congress. This bottom-up process is a good example of how Congress is supposed to make law.”

HOUSE, SENATE RELEASE BIPARTISAN AGREEMENT ON GOVERNMENT FUNDING AS SHUTDOWN DEADLINES LOOM

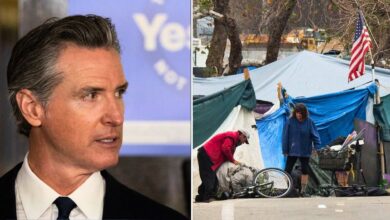

US House Speaker Mike Johnson, a Republican from Louisiana, speaks during a news conference at the US Capitol in Washington, DC, on Tuesday, Jan. 30, 2024. (Al Drago/Bloomberg via Getty Images)

The bill is a result of negotiations between House Ways & Means Committee Chairman Jason Smith, R-Mo., and Senate Finance Committee Chairman Ron Wyden, D-Ore. It’s aimed at temporarily expanding the child tax credit while also reviving key tax deductions for small businesses, including for research and development conducted inside the U.S.

But it’s faced pushback from an unusual coalition of conservative and moderate Republicans, albeit for different reasons. GOP hardliners have claimed the bill’s child tax credit would be available to illegal immigrants, something Smith had vehemently denied.

HOUSE GOP ERUPTS IN DIVISION OVER CALL TO PUSH JOHNSON OUT OF SPEAKERSHIP: ‘WORKING FOR JOE BIDEN’

It was negotiated by House Ways and Means Chairman Jason Smith (Bill Clark/CQ-Roll Call, Inc via Getty Images)

Meanwhile, moderates, specifically from the suburbs outside of major cities like New York City and Los Angeles, were frustrated the bill does not touch state and local tax (SALT) deduction caps. They’ve argued it’s a critical issue for their swing district constituents, and could make or break House Republicans’ chances of holding onto their razor-thin majority in November.

Both groups were also angry at House GOP leaders’ decision to put the tax bill up for a vote under suspension of the rules, a maneuver that allows legislation to bypass a committee vote and a procedural “rule” vote in exchange for lifting the threshold needed for passage from a simple majority to two-thirds.

HOUSE VOTES TO AVOID GOVERNMENT SHUTDOWN AFTER SPEAKER JOHNSON BUCKS GOP REBELS

That decision came after Freedom Caucus members weaponized rule votes several times during this Congress to shoot down GOP priorities in protest of Republican leadership’s decisions.

Long Island Republican Congressmen Nick LaLota, left, and Anthony D’Esposito protested over the bill on Tuesday. (Getty Images)

The tax bill is expected to pass along comfortable bipartisan lines. In addition to GOP criticism, it’s also faced some scrutiny from progressives who say the child tax credit provisions don’t go far enough.

A group of four New York Republicans threatened to tank a procedural vote for an unrelated GOP-led measure over the SALT exclusion, but two sources told Fox News Digital that they later secured a commitment from Johnson to bring a separate, targeted SALT bill to the floor at some point soon.