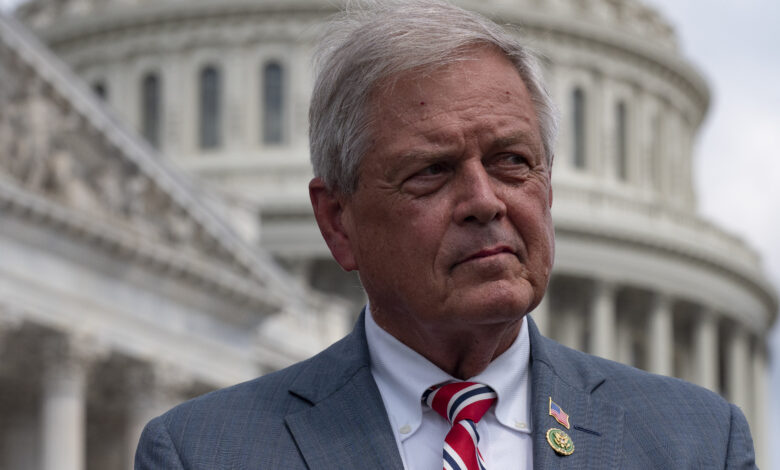

Ralph Norman is down a massive rabbit hole after his latest meme stock conspiracy

Ralph Norman is a bit off. Don’t take my word for it. Do as I did and interview some GOP staffers who work with the Republican congressman from South Carolina and they will walk you through some of his greatest hits. Among them: He urged former Trump chief of staff Mark Meadows in a text to institute something known as “Marshall Law,” so the former president could stay in office after being defeated by Joe Biden in 2020. Spelling, among other things, isn’t Noman’s strong suit.

I can go on and on and on, but I’ll stop at the latest bit of Crazy Town that Norman is embracing: Conspiracy theories involving a meme stock known as MMTLP. It appears that with all the things that really impact his constituents in South Carolina (migrants, the economy, inflation, terrorism), the congressman thinks there is something fishy going on between securities regulators and possibly some nefarious forces on Wall Street to rip off people who bought into this as the next get-rich-quick scheme in so-called meme investing.

He’s calling for an investigation and hearings from House Financial Services Committee Chair Patrick McHenry. Norman is cementing his rep as a wing nut who is also financially illiterate.

Most people never heard of MMTLP, and many who have wish they didn’t. It has a convoluted history, even if its trajectory followed a similar pattern in the meme era: A get-rich-quick scheme that eventually turned to dust. Recall how the memes — retail investors who share trading tips on social media and then pile into stocks — piled into AMC Theatres and the now-defunct Bed Bath and Beyond. They got crushed when the irrational exuberance wore off and social-media pumping ceased to work.

That’s what happened to those poor souls who in late 2022 began snapping up MMTLP, a preferred stock issued after a public company known as Torchlight Energy Sources did a reverse merger with something called Meta Materials. The shares were designed as a claim on some oil and natural gas that is supposed to exist in West Texas. Eventually MMTLP would evolve into a non-tradable stock in a new private company called Next Bridge Hydrocarbons.

Welcome to Crazy Town

Yeah, I know it sounds like a mess. Oil wells in West Texas; reverse mergers, a nascent private company, and a preferred stock that found its way onto the over-the-counter market, the so-called pink sheets, where a lot of crazy stuff goes down.

And it gets messier. Toward the end of 2022, the meme crowd, which gets most of its research from social-media touts, got wind of MMTLP and saw it as the next great “short squeeze” — they would make a killing by buying up the float, and hold it until the bitter end when the shorts capitulated.

Short sellers, of course, make their vig by betting stocks will decline in value. They begin by borrowing shares, selling them, and eventually replacing the borrow with lower-priced stock.

A squeeze turns the tables on the shorts — which is what the memes wanted. They began spreading tall tales on social media that they could crush short sellers by bidding up the price so high that the shorts would have to cover their borrow at ever higher levels.

Let’s just say things didn’t work out as planned. First, the short sellers weren’t that interested in MMTLP, it turns out. There was no squeeze like the one that took place around shares of GameStop in early 2021 and put a short hedge fund out of business.

Plus, the memes didn’t appear to read any company press releases or understand how stocks settle or some unique attributes of MMTLP. The meme crowd thought they could sell up to Dec. 9 to get the biggest bang for their buck. But MMTLP was set to dissolve into nontradable shares of Next Bridge on Dec. 12, 2022, which means, under settlement rules, you have to sell by Dec. 8 or you’ll get the nontradable Next Bridge stuff most holders didn’t want.

Those who tried to sell after Dec. 8 — and they are legion, if the cries on social media are any indication — were, as they say, SOL (s–t out of luck); their MMTLP turned into nontradable shares of Next Bridge.

Oops.

Norman has heard those cries and he appears to think there’s some grand scheme involved among the Securities and Exchange Commission, its sister agency, the Financial Industry Regulatory Authority (FINRA) and maybe some unscrupulous Wall Street types. Now he’s “demanding answers,” even after FINRA provided him with pages of detailed answers, which like the memes he either didn’t read or doesn’t understand.

According to FINRA, it halted trading in MMTLP on Dec. 9 to make sure people didn’t buy a security that didn’t exist. Sounds reasonable to me, though the agency should also have proposed mandatory investor education courses for anyone still complaining how they lost money on this boondoggle.

To do something substantive, Norman must get buy-in from McHenry, who like most Republicans isn’t a fan of the famously left-wing SEC chief Gary Gensler. That doesn’t mean McHenry is keen on following Norman down any of his rabbit holes, MMTLP included. As one GOP committee staffer told Fox Business’ Eleanor Terrett, the leadership consensus on MMTLP is that it’s “a lot of smoke and no fire.”

Sounds like McHenry also knows financial illiteracy goes beyond the meme crowd to include a certain member of his team.

McHenry and Norman declined to comment.