Inside Nvidia’s takeover of the world of AI

There are two reasons to write a business book, according to Brad Stone, author of “The Everything Store.” You’re either writing a thriller or a how-to-manual.

In “The Nvidia Way,” veteran technology journalist Tae Kim manages to do both.

Kim charts the improbable rise of Nvidia from a fledgling three-person ‘90s era graphics chip startup, one of countless others in a crowded and cutthroat field, to the largest and most influential computer company in the world.

Kim also lays out the reasons for Nvidia’s success. It wasn’t just that they had talented leaders, good timing, or industry-leading technology.

Nvidia succeeded because it cultivates a unique culture of excellence which he dubs “The Nvidia Way.”

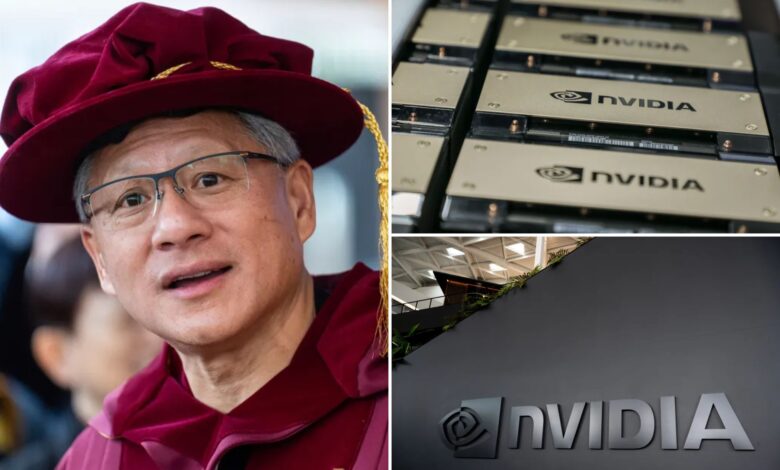

At the center of this story is CEO Jensen Huang, described by one employee in the book as an “extremely persuasive and extremely hard working” leader, who has been leading the firm and shaping this culture since its founding in 1993.

Huang is one of the longest-tenured CEO in the technology industry and one of the few lone founders still running the show.

As Kim readily acknowledges, the Nvidia Way is really the Jensen Way. He sets the culture.

What is the Nvidia Way? First, hire the best people.

When in doubt, go for raw talent over experience. Second, reward performance and compensate your best people very well. Third, demand excellence and accountability from everyone all the time, starting at the top.

Huang is a Taiwanese immigrant of humble origin who excelled in math and table tennis and graduated high school at 16.

He later befriended Nvidia’s other co-founders, Curtis Priem, who also began programming computers in high school, and Chris Malachowsky, who realized midway through his MCAT exam he didn’t want to be a doctor, in Silicon Valley’s tight-knit community.

Over countless coffees at a neighborhood Denny’s, they convinced each other to quit their jobs and start a new company. From day one, Huang was CEO.

Priem and Malachowsky are interesting figures, and we get to know them a little, but if the Nvidia story was the Avengers, Huang is Iron Man, the star of the show.

Nvidia launched at “the perfect time,” says Kim. By 1993, the demand for graphics chips powering video games like “Doom” was exploding.

But despite the favorable market conditions, Nvidia’s first chip, the NV1, was a flop.

“Nobody goes to the store to buy a Swiss Army knife. It’s something you get for Christmas” Huang later recounted about the product, which was fatally overengineered.

“When we were younger, we sucked at a lot of things, ” says Huang,” adding that Nvidia might have done better if he simply was not around in the first five years.

A new chip, the RIVA 128, saved the company. Nvidia even turned a modest profit in its first year. This success would be short-lived.

The next half-decade was characterized by both big wins, and large setbacks. “Building a company is a new skill,” Huang admits.

Nvidia often found itself on the back foot early on. Designing and launching a graphics card took more than a year, but chip buyers were refreshing their lineup of PCs every six months, meaning no one company could ever stay on top.

Huang’s solution: “We’re going to fundamentally restructure the engineering department to line up with the refresh cycles.” This decision changed the chip industry as every other competitor was forced to keep pace or die.

Huang calls this “moving at the Speed of Light,” the theoretical limit of how fast anything can travel, to win. A “Star Trek” fan, he was talked out of dubbing this culture of quickness the much geekier “Mycelium Spore Drive.”

After a few years, Nvidia began to hit its stride, going public in 1999 and then winning the contract for the first Xbox from Microsoft.

Later, Nvidia grabbed 85% of Apple’s entire computer lineup.

As the company grew more successful, Huang became obsessed with “The Innovator’s Dilemma,” a concept coined by professor Clayton Christensen, which describes how incumbents are often disrupted by more nimble upstarts.

Huang’s fear of getting disrupted drives him. “The only thing that lasts longer than our products is sushi,” he likes to joke. It’s why he’s partial to erasable whiteboards, which “represent the belief that a successful idea, no matter how brilliant, must eventually be erased, and a new one must take its pace.”

Nvidia’s first true killer product was the graphical processor unit, or GPU, launched in 2003.

The GPU changed the market perception by putting the GPU (the graphics engine) on par with a better-known CPU, or central processing unit. This was more than marketing hyperbole.

The new class of chips was programmable, which meant they could be used for a myriad of use cases.

At first, Nvidia had no clue just how versatile the GPU truly was. “Really the modern GPU, we kind of stumbled onto,” said Nvidia scientist David Kirk.

As it turned out, super powerful graphics engines were great for other kinds of computation, including the nascent field of AI research. In fact, academics credit Nvidia’s GPU with leveling the playing field in research by democratizing computing power.

Recognizing the AI opportunity early, Huang declared in 2012, “We need to consider this work as our highest priority.”

To make the GPUs easy for non-graphics users to program, Nvidia created a software interface known as CUDA (Compute Unified Device Architecture).

Over time, CUDA became the company’s greatest asset. Once you get used to programming chips in one environment, you never want to leave.

Nvidia also began aggressively cultivating AI researchers through grants, joint ventures, and partnerships with academia. This decades-long effort helped to effectively create a market for its GPUs.

As Nvidia grew, they remained vigilant against the corporate bloat and inertia that kills companies. Huang hates corporate hierarchy. “You want a company that’s as large as necessary to do the job well, but to be as small as possible.”

For him, the goal is to have a Vulcan mind meld (another “Star Trek” reference) with his people, where people can share and anticipate each other’s thoughts.

Kim’s book leaves readers with the impression the AI age is just getting started. Nvidia, for their part, thinks the entire data center market, made up mostly of CPUs, will need to switch to GPUs, representing more than a trillion dollars in chip purchases.

The “big bang” for Nvidia came in 2023, shortly after the release of ChatGPT, when the company beat its revenue estimates by a staggering $4 billion.

For some, Nvidia’s rapid ascent to being the world’s largest company was a shock.

For anyone paying attention, Kim argues, their eventual success should have been obvious.

“It is Jensen’s personal will that has shaped Nvidia,” says Kim, asking what happens when he and the company part ways. That question goes unanswered. For now, Nvidia sits unassailable atop the mountain, surrounded by a cultural moat few can traverse.

Alex Tapscott is the author of “Web3: Charting the Internet’s Next Economic and Cultural Frontier” and managing director of the Digital Asset Group, a division of Ninepoint Partners LP