Who’ll win NYC’s casino race? Gambling experts set odds

As New York’s summer grinds on, the battle for three city casino-licenses heats up.

Proposals — plus $1 million application fees — are due on August 31 and billions hang in the balance.

Outside of two racinos — Resorts World New York City in Queens and Empire City in Yonkers — which already have profitable electronic gaming and are said to be front-runners, the six remaining contenders face local opposition.

“Companies are spending millions on lobbyists,” a political insider told The Post. “And no part of the city wants a new casino.”

With the billion-dollar craps shoot poised to kick off and licensing due by late 2025, here are the contenders and their odds of throwing 7s:

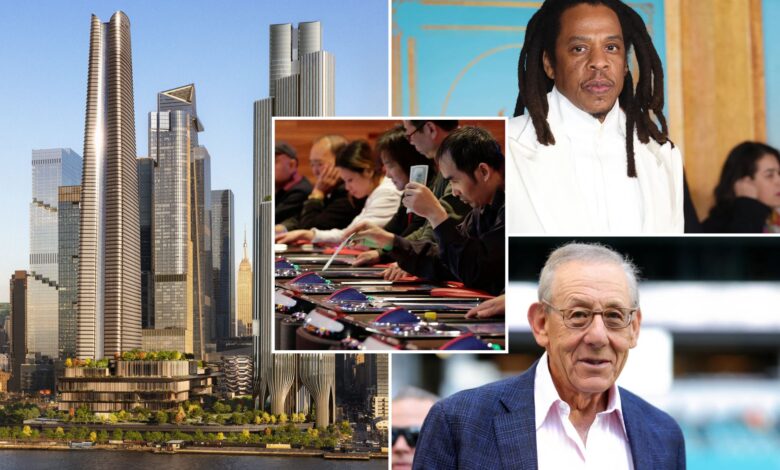

Stephen Ross and Wynn Resorts

Budget: $12 billion

Public bonus: 5.6-acre park, public school

Casino: Wynn New York City

Set for glimmering Hudson Yards, Wynn NYC will boast an 80-story hotel/casino and splashy restaurants. Considering Wynn’s rep for quality, it should fit in among the glass towers.

“We are creating a destination resort,” Michael Weaver, chief communications officer of Wynn, told The Post, adding that in-house live entertainment will be out of the mix. “We’ll align with the city’s shows, sporting events and concerts.”

But local Community Board 4 complains that the casino would replace housing (going from 5,700 units to 1,507) that had been promised by Stephen Ross’s Related Companies, which developed Hudson Yards.

Bennett Liebman, formerly Andrew Cuomo’s deputy secretary on gaming and racing, wondered to The Post: “Will they get past the community review board?”

Andrew Rosen, Related’s chief operating officer of Hudson Yards, sounds unworried. “We promised 324 units of affordable housing. We will put up the 324 units. The community has not yet seen what we are doing.”

Odds for approval: 3 – 1. “Wynn and Related are the best,” Alan Woinski, president of the casino consultant Gaming USA, told The Post. “I think they’ll get little opposition; the project’s scale is impressive.”

MGM Resorts International

Budget: $3 billion

Public bonus: Tripling the largely local workforce already employed there

Casino: Empire City

Yonkers Raceway introduced slot-machine-style gaming in 2006 via Empire City Casino.

In 2018, MGM Resorts International – owner of Las Vegas’ Bellagio and others – bought the racetrack and Empire for $850 million.

Now it’s aiming for a full-on gaming license.

Mitchell Moss, professor of urban policy and planning at NYU, sees the racino and its plans for a 301,200 square foot expansion as a shu-in: “It has a record of success and will easily expand.”

Odds for approval: Even money “They should already be licensed,” said Woinski. “They’ll generate tax dollars in six months” – with gaming tables while the expansion goes on. “You’d be nuts to not give it to them.”

Stefan Soloviev and Mohegan Sun

Budget: $10 billion

Public bonus: 6.7 acres of green space and the Freedom Museum (which will include Soloviev’s personal chunks of the Berlin Wall)

Casino: Freedom Plaza

Stefan Soloviev is viewed as a Manhattan dark horse.

Despite an offer to build 1,325 apartments, 513 of which would rent below-market, with 1,200 hotel rooms, Soloviev and Mohegan Sun’s Midtown East spot has attracted jeers from the community.

One described gambling profits as “blood money.” Rep. Jerry Nadler’s district director, Robert Gottheim, fretted about “the most vulnerable people spending their paychecks on gambling.”

Moss, from a city-planning perspective said of the casino, “It does not fit into the neighborhood. You don’t need a casino near the Queens Midtown Tunnel.”

Undaunted, Soloviev responded to gambling haters. “The [subterranean] casino is only a small part of the entertainment district we’re putting in,” he told The Post. “I think they will like it once it is done.”

Odds for approval: 50 – 1 “[Soloviev] has no experience [with a casino],” said Woinski. “And Mohegan is out of Virgin Hotels” in Vegas. Mohegan Sun had previously managed the Virgin Hotels’ casino; according to reports, neither side explained the split.

Genting Group

Budget: $5 billion

Public bonus: More than 10 acres of green space

Casino: Resorts World New York City

As a racino — a racing track and casino attached — operating since 2011, Resorts World NYC claims to rank as America’s highest-performing non-tribal casino outside of Las Vegas.

And that’s without table games such as blackjack and roulette.

However, it may face blowback against licensing due to allegations Los Angeles Dodgers’ baseball star Shoehei Ohtani’s translator gambled with bookies who parked money at Resorts World in Las Vegas.

Nelson Rose, an expert on gambling law, told The Post the scandal is “bad news,” as “one of the standards for casino licensing is reputation.”

Meghan Taylor, senior vice president of government affairs and public relations for Resorts World NYC, responded to The Post, “Resorts World Las Vegas is a separate company from Resorts World New York. There is zero overlap between the senior management.”

Besides, she added, if given the green light, “We’ll be able to flip cards within six months” – thus generating tax revenue almost instantly

Odds for approval: Even money. “If there was an issue, related to Vegas, there would have been a hearing on the slot machines [at Resorts World NYC],” said Woinski. “This property is going to be a fantastic casino.”

Bally’s Corporation

Budget: $3 billion

Public bonus: Police substation within the gaming facility

Casino: Bally’s Bronx

Bally’s Corporation bought Bronx Links golf course from Donald Trump in 2023.

It hopes to convert portions of the course’s parking lot and practice range, which count as parkland, into a casino site.

Lawmakers in the Bronx have yet to support that plan – which would need special permission, known as “parkland alienation” — and it leaves Bally’s in the rough.

Though locals are cool to the project that would bring a casino/hotel/spa to the borough, Christopher Jewett, senior vice president of corporate development, insisted to The Post that the location is an asset.

“Assuming that MGM and Resorts are layups, we’re right between them,” he said. “We’re the best location in terms of not diluting anyone else’s revenue.”

Odds for approval: 60 – 1. “Bally’s is stretched financially,” said Woinski, referring to the company’s billions of dollars in debt and a $172 million net loss in 2023. “I would ask if they are sure they want to do a project of this size.” A shareholder recently posed the same question.

Steve Cohen and Hard Rock International

Budget: $8 billion

Public bonus: 25 acres of new park space

Casino: Metropolitan Park

Steve Cohen typically gets his way – and pays the price for it.

He wanted Damien Hirst’s famous shark preserved in formaldehyde – and coughed up $8 million.

Then there is his purchase of the Mets ($2.4 billion).

Topping them all, Cohen’s casino – plus food-hall, hotel, music venue.

A source affiliated with the project told The Post, “This is a once in a lifetime opportunity.”

But not for everyone.

Parkland alienation is an issue for Cohen, as it is for Bally’s. State Senator Jessica Ramos has vowed that she “will not introduce legislation to alienate [Cohen’s property] for the purposes of a casino,”

However, as put by the source, “We have multiple pathways to secure required approvals.”

Odds for approval: 25 – 1. “If a person doesn’t approve of gambling, you can’t convince them otherwise,” said Woinski. “I don’t see any way around [Ramos].”

Thor Equities, Chickasaw Nation’s Global Gaming Solutions, Saratoga Casino Holdings, Legends Hospitality Group

Budget: $3 billion

Public bonus: Year-round Skee-Ball

Casino: The Coney

This ambitious future casino leans on the past.

“Coney Island is one of the city’s oldest entertainment districts,” Robert Cormegy, a project consultant and former New York City Council member told The Post, adding that the Coney crew aims to bring back that vibe.

Nevertheless, last year, the local community board voted against the casino proposal.

One feared that Coney Island would mimic blighted Atlantic City.

Cornegy insists they are playing ball. “We are incorporating the community’s needs. We’re putting in Coney Island attractions on the ground floor and the casino upstairs.”

He also points out Coney Island has been under-invested in, adding, “We can impact the community. I don’t know if you have the same effect in Manhattan.”

Odds for approval: 40 – 1. “I like this project, but there are so many hands in it,” said Woinski. “I don’t think they have what it takes to bring this in.”

Contenders: Jay-Z, Caesars Entertainment, SL Green

Budget: $TK billion

Public bonus: Jay-Z curating the entertainment

Casino: Caesars Palace Times Square

Some entities around the Times Square location are not hailing Caesars.

Despite the project’s offer of $117 million to go toward theater tickets for kids and education for would-be actors, the Broadway League is against the casino (fearing that it will take butts out of theater seats).

On the other hand, a group of neighborhood landlords have expressed support for the proposed gambling den.

A resounding 71 percent of registered voters in the area voiced opposition – however, the poll was done by the No Times Square Coalition.

But Brett Herschenfeld, executive vice president of retail and opportunistic investments at SL Green, is optimistic.

He told The Post, “Caesars Palace Times Square is a project designed to uplift all of these Times Square businesses through investment and shared economic benefit.”

As for Jay-Z’s role, in December 2022, a source told The Post, “It is hoped that Jay … could handle residencies like the one that Adele has in Las Vegas.”

Odds for approval: 25 – 1. “There is no convenience in Times Square,” said Woinski. The best way to get there is on the subway. Do you want to ride there with $5,000 in your pocket? If they get local approval, which is a longshot, I make them 10 – 1.”