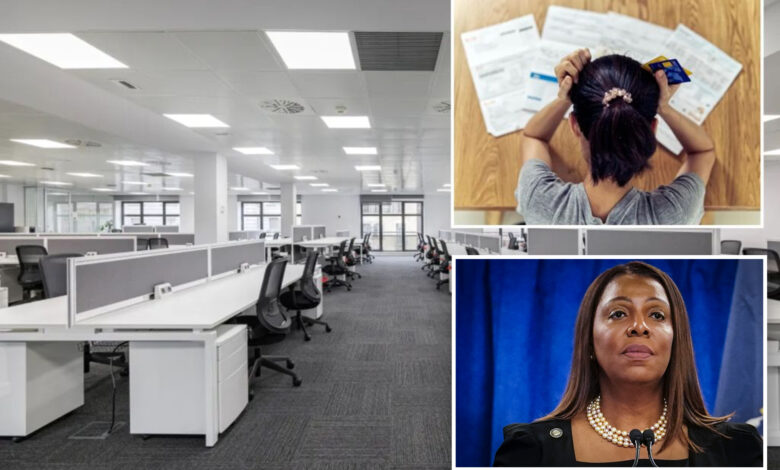

Unpaid NYC property taxes to hit record $880M: ‘no consequences’

New York City officials are forecasting overdue property taxes will surge to a record $880 million in the current fiscal year — and they say it’s because they’ve lost the power to enforce punishments for delinquencies.

The staggering figure — forecast for the fiscal year ending in June — marks a jump of more than 30% from three years ago, according to an offering document for a city general obligation bond sale Tuesday obtained by Bloomberg.

“It’s not just the absolute dollar amount that I think should worry us all,” Preston Niblack, the city’s finance commissioner, said at a City Council finance committee meeting earlier this month.

It’s people realizing that “there are no consequences for not paying your property taxes,” he added, per Bloomberg. “That just can’t be allowed to continue.”

Among the highest debtors are the owners of a 16-unit rental building in Cobble Hill, Brooklyn, who owe $52.2 million, as well as a 49-unit apartment building in the Bronx that owes $24.7 million, according to a list compiled by the city Department of Finance for Bloomberg.

City officials have blamed the rise in unpaid property taxes on the end of a tax-lien sales program that punished delinquency during the pandemic, according to Bloomberg.

The program expired in March 2022 and wasn’t reauthorized by the City Council, Bloomberg reported, leaving delinquent owners without incentive to pay their debts. The Department of Finance reportedly is working on legislation that would bring back tax-lien sales ensuring homeowners don’t face foreclosure or eviction.

Under the plan, if homeowners of single-family homes and condos were delinquent for three-plus years, the city could seize and sell the real estate to satisfy the debt. On other property types, liens could be sold after just one year, Bloomberg reported.

Per New York City’s Housing Prevention & Development website, if the property owner refuses to cough up the taxes — or other unpaid municipal charges like housing maintenance-, water- or sewer-related bills — the lienholder may foreclose and the building will be sold at auction.

The city would bundle its most marketable liens into securities for sale at a discount to a third-party trust, which borrows money from investors to pay the city upfront, according to Bloomberg.

The trust then assumes responsibility for collecting the debt, plus additional fees and interest payments, so that after investors are paid back, the city can continue collecting additional revenue from those added costs.

New York Attorney General Letitia James criticized those fees back in December 2020 for having the ability to “quickly turn a relatively small tax lien into an overwhelming financial burden, eventually pushing homeowners into foreclosure.”

She cited the mandatory 5% surcharge, legal fees, and a 9% or 18% interest rate that compounds daily, according to Bloomberg.

Surging property-related debt comes at a time when owners of some of New York’s costliest real estate — office buildings — are struggling to lure tenants.

The overall vacancy rate for Manhattan office space stood at 22.5% in November 2023, the highest on record, according to the city’s January financial plan.

The delinquencies mean New York City is missing out on tax revenue — of which close to 50% comes from property tax collections.

In the current fiscal year ending in June 2024, New York City is expecting to collect $32.7 billion in property taxes, which will account for roughly 45% of city tax revenue and almost 30% of total funds for the city’s $114 billion budget, according to Bloomberg, citing the January financial plan.