Supply-Side Trumponomics, Part Three: Regulatory Reform

In previous articles, we looked closely at two of the three main pillars to President-elect Trump’s supply-side economic growth agenda: Increasing energy production and cutting taxes. Now for the third and final pillar, regulatory reform.

As anyone who’s ever taken a decent Principles of Economics course knows, prices are determined by the “market forces” of supply and demand. Demand represents consumers’ preferences over various goods, while supply represents the “costs of production” businesses face in producing those goods.

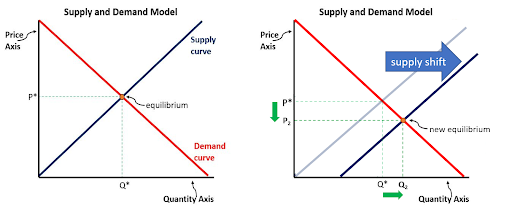

Economic growth happens over time when forces begin to shift the supply curve to the right. I hammer this point home with my students and make them repeat the slogan, “The recipe for economic growth is to push the supply curve to the right.”

Government regulations imposed on businesses and their products, however, act just like taxes in that they raise the cost of production, pushing the supply curve for any given product “up and to the left,” which raises price and reduces quantity.

Likewise, government actions that ease or remove those regulations have the opposite effect, pushing supply curves “down and to the right,” reducing price, raising quantity, and increasing economic growth.

Supply-side economists like Art Laffer tout the benefits of Trump’s big 2017 tax cut package, and certainly those tax cuts paid off handsomely in Trump’s first term economy (pre-Covid). Renewed tax cuts will have a similar effect in Trump’s second term. But according to Trump himself, business leaders told him repeatedly that his regulatory reforms were an even more powerful tool for boosting productivity and growth.

Deregulation

Regulations are like taxes in that they impose costs on businesses, but burdensome regulations are worse than taxes because in most cases the people get little to nothing in return. At least with taxes the government gets revenue that it can ostensibly use for infrastructure, defense, and other public goods.

According to the Competitive Enterprise Institute’s annual report on the federal regulatory burden, “Ten Thousand Commandments,” as of 2024, federal regulations impose costs north of $2.1 trillion on the U.S. economy. Government paperwork takes up 10.34 billion hours of work time, and the government’s regulation log — the federal register — checks in at well over 89,000 pages, very close to its all-time high at the end of the Obama years.

Regulations are like barnacles on a ship: each one is small, seemingly insignificant, and invisible to the casual observer. Over time, however, regulations accumulate and greatly impair the ship’s hydrodynamic efficiency. It’s well past time to give the hull of this economy a massive scrubbing.

Trump’s first term featured a big push to reduce the regulatory burden on U.S. businesses. He famously targeted a 2:1 regulatory reform ratio — for every new rule enacted, two existing regs would be eliminated. This valiant effort bore some fruit. Trump had a few notable deregulation successes early in his first term. Many of these were simply Congressional vetoes of impending Obama-era regulation, but Trump also made strides in streamlining the permitting process for infrastructure projects.

Trump’s efforts pushed the federal register to a modern low of 61,308 pages, and Trump’s first term saw far fewer new regulatory measures as compared with recent administrations. Ultimately, Trump’s first-term deregulatory program was a mixed bag, as many deregulation efforts were stymied by “deep state” resistance or held up in the courts.

Trump knows the power of deregulation and has pledged to boost the regulatory reform ratio to 10:1 in the second term — axing ten rules for each new one adopted. This is ambitious to be sure, but much can be done by simply peeling off regulations that were piled on by the Biden administration.

The incoming Trump administration has already taken concrete steps to sharpen their focus on government regulation reform and addressing waste with the new Department of Government Efficiency (DOGE) run by Elon Musk and Vivek Ramaswamy. Congress will also play a big role in this process, as will Trump’s solid deregulation-minded cabinet picks like Lee Zeldin (EPA), Chris Wright (Energy), and Doug Burgum (Interior). These men know their economics and are fully aware that burdensome regulations stifle economic growth like nothing else.

CHECK OUT THE DAILY WIRE HOLIDAY GIFT GUIDE

Deregulatory efforts in the second Trump Administration will also be hugely abetted by the Supreme Court’s recent ruling repealing so-called “Chevron deference” which will significantly pare back government agencies’ rule-making powers and really grease the skids for deregulation.

Tax cuts, regulatory easing, and booming energy production — each of these policy levers has, by itself, the potential to restore strong growth in output, jobs, and personal incomes. If president Trump’s next administration can hit the supply-side trifecta, he will almost certainly be able to deliver on J.D. Vance’s promise of the “greatest economic comeback in American history.”

Donald Trump may well go down in history as the leader who made “supply side economics” a household word and showed us all the wonderful possibilities when policymakers who understand basic economics have the guts to ignore the tut-tutting experts and wreck the uniparty consensus that tolerates economic stagnation. Full speed ahead with the supply-side reform package. We should do everything we can to help Donald Trump push supply curves to the right and Make America (economically) Great Again.

* * *

RELATED: Supply-Side Trumponomics, Part One: ‘Drill, Baby, Drill’

RELATED: Supply-Side Trumponomics, Part Two: Tax Cuts

* * *

Tyler Watts is a professor of economics at Ferris State University in Big Rapids, Michigan.

The views expressed in this piece are those of the author and do not necessarily represent those of The Daily Wire.

Continue reading this exclusive article and join the conversation, plus watch free videos on DW+

Already a member?