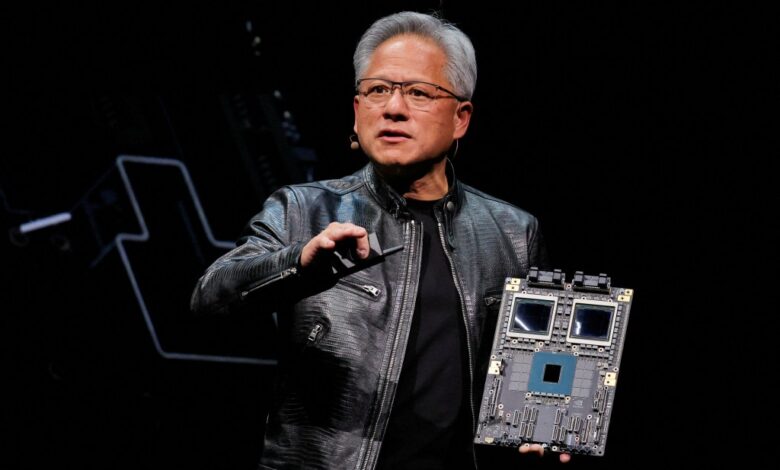

Nvidia shares slide after China launches probe of suspected anti-monopoly violations

Shares of Nvidia slid early Monday after China said it is investigating the high-flying microchip company over suspected violations of Chinese anti-monopoly laws.

In a brief press release with few details, Chinese regulators appear to be focusing on Nvidia’s $6.9 billion acquisition of network and data transmission company Mellanox in 2019.

Nvidia shares dipped 3% on Monday, falling below $140.

Considered a bellwether for artificial intelligence demand, Nvidia has led the AI sector to become one of the stock market’s biggest companies, as tech giants spend heavily on the company’s chips and data centers needed to train and operate their AI systems.

Nvidia’s shares have nearly tripled this year with the California company revenue and profit soaring on AI demand. According to data firm FactSet, about 16% of Nvidia’s revenue comes from China, second only to its US-generated revenue.

In its most recent earnings release, Nvidia posted revenue of $35.08 billion, up 94% from $18.12 billion a year ago. Nvidia earned $19.31 billion in the quarter, more than double the $9.24 billion it posted in last year’s third quarter. The earnings release did not break out revenue from China.

The company’s market value rocketed to $3.5 trillion recently, passing Microsoft and briefly overtaking Apple as the world’s most valuable company.

Nvidia’s invention of graphics processor chips, or GPUs, in 1999 helped spark the growth of the PC gaming market and redefined computer graphics.

Last month, the Santa Clara, Calif.-based tech giant replaced Intel on the Dow Jones Industrial Average, ending the pioneering semiconductor company’s 25-year run on the index.

Unlike Intel, Nvidia designs but doesn’t manufacture its own chips, relying heavily on Taiwan Semiconductor Manufacturing Co., an Intel rival.

China’s antitrust investigation follows a report this summer by technology news site The Information that the Justice Department was investigating complaints from rivals that Nvidia was abusing its market dominance in the chip sector.

The allegations reported include Nvidia threatening to punish those who buy products from both itself and its competitors at the same time.