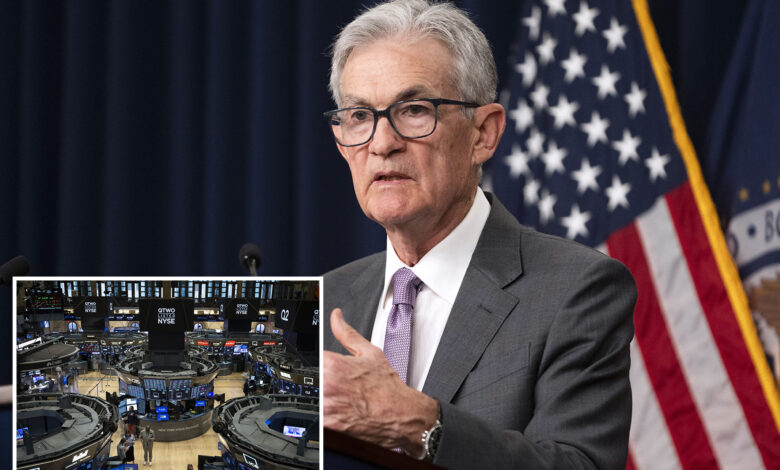

Investor hopes high for bigger interest rate cut, sending Dow near all-time high

Hopes for a big rate cut from the Federal Reserve next week got suddenly revived, sending the Dow near an all-time high.

Stock and bond traders ramped up bets on Friday that the Fed could slash interest rates by 50 basis points — or half a percentage point — after the Wall Street Journal reported that central bankers have become increasingly focused on the health of the US job market versus inflation.

The Dow closed up 297 points to 41,393 — not far off its Aug. 30 record close of 41,563.

After practically writing off the chance of a 50-basis-point cut earlier this week, traders in swaps markets most recently were predicting a 47% chance that Fed officials could opt for a bumper cut at a policy meeting next week.

Still, in what it is expected to be the first lowering of rates since 2020, a thin majority of 53% chance are forecasting the more typical rate cut of 25 basis points on the central bank’s current key lending rate of 5.25% to 5.5%.

“A couple of articles were published in the Wall Street Journal and the Financial Times suggesting that a 50-bps move was still in play, which has led markets to once again reevaluate their expectations,” Deutsche Bank analysts said in a note to clients.

Former Federal Reserve chair Bill Dudley said on Friday there was “a strong case” for the larger cut at a forum in Singapore.

“I know what I’d be pushing for,” said Dudley, who led the New York Fed until 2018. “The question is why don’t you just get started? It’s basically up to Chairman Powell to see how much support he has for being more aggressive.”

Bob Savage, head of markets strategy at BNY Mellon, said that investors want the Fed “to ease fast and get on with the risk of recession fighting.”

The reportedly planned cut comes after August’s lower-than-expected lab our market numbers in which there were 142,000 jobs created.

“The time has come for policy to adjust,” Fed Chair Jerome Powell said in his keynote speech at the Fed’s annual economic conference in Jackson Hole, Wyoming last month. “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

A cut in interest rates would lower borrowing costs for American households by making repayments on credit cards and home loans cheaper.

That, in turn, could also potentially encourage customers to spend and businesses to invest in a move that would boost the US economy less than two months before the election amid fears of a possible recession.

Inflation – the price rise in key goods – appears to have been tamed in recent months after the Fed kept interest rates unchanged for the past 14 months.

In August, consumer prices rose 2.5% ahead of November’s presidential vote where the cost of living is expected to be one of the major issues as Americans head to the polls.

That is down from its recent peak of 9.1% in June 2022 when governments worldwide were dealing with the fallout from the global coronavirus pandemic.

UBS’s Brian Rose, senior US economist, wrote in a note that “the inflation data has been good enough to allow the Fed to start cutting rates in September, but does not give them a reason to cut aggressively.”

“If the Fed does 25, not 50 bps, investors will need to reconsider some of the more optimistic cyclical rally or no recession narratives,” said Arnim Holzer, Global Macro Strategist at Easterly EAB Risk Solutions.

The Fed would be joining a global rate cut cycle after the European Central Bank, which sets rates for the 20-nation single currency eurozone, announced its second rate cut on Thursday in three months.

ECB officials in Frankfurt, Germany pointed to slowing inflation and stronger economic growth as the reasons for the cut in interest rates.