Inflation rates show Biden is gaslighting Americans on the economy

Good news: Inflation eased a tiny bit in the latest Consumer Price Index numbers.

Bad news: Most other indicators suggest more trouble, not less, ahead.

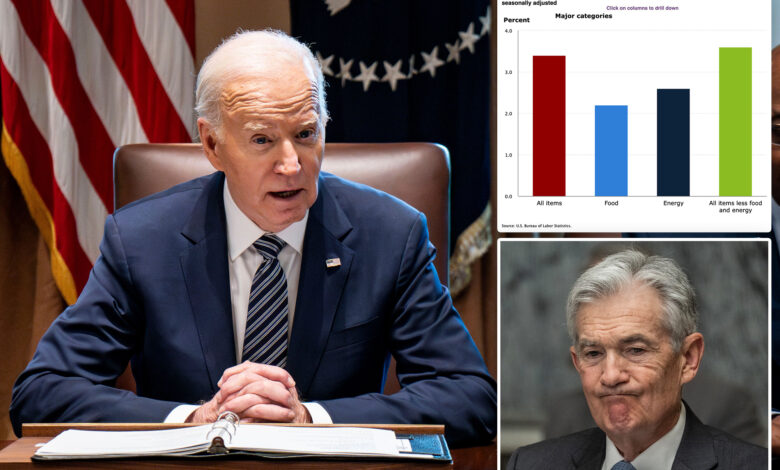

CPI for April came in at 3.4% higher than a year ago — easing from March’s 3.5% spike.

But we’re still at levels well above what Federal Reserve chief Jerome Powell wants.

And the Producer Price Index for April saw a 0.5% rise, above economists’ 0.3% prediction — and PPI generally indicates where CPI is headed, since producers have little choice but to pass higher costs on to consumers.

Plus, Consumer Confidence in April was at its lowest level since July 2022, when inflation was at a blistering 8.5%.

Meanwhile, interest rates have been at a 23-year high since last July; Wall Street keeps hoping the Fed will cut rates, but Powell’s (rightly) promising nothing.

Which leaves the working and middle class squeezed, and racking up more debt: Americans have already spent their pandemic savings while credit-card balances soar.

Meanwhile, job growth slowed last month, and the majority of jobs added were in government and health care (which is itself government-dominated): Private-sector employment looks flat.

The specter of stagflation looms heavy.

By every metric, Bidenomics has miserably failed Americans; prices are now up an average 20% over Inauguration Day 2021.

The president’s response?

Lie outright, insist you have the money to cover your soaring grocery bills and hope enough people believe him that he can get voted in for Round 2 in November.

Gas prices may be up, but Joe Biden’s gaslighting keeps getting cheaper.