Identity of Wall Street ‘meme-lord’ behind Litquidity account revealed

The Wall Street “meme-lord” behind the social media account Litquidity — which famously aired junior Goldman Sachs bankers’ gripes about 100-hour work weeks during the pandemic — has been identified as a 32-year-old former Deutsche Bank investment banker.

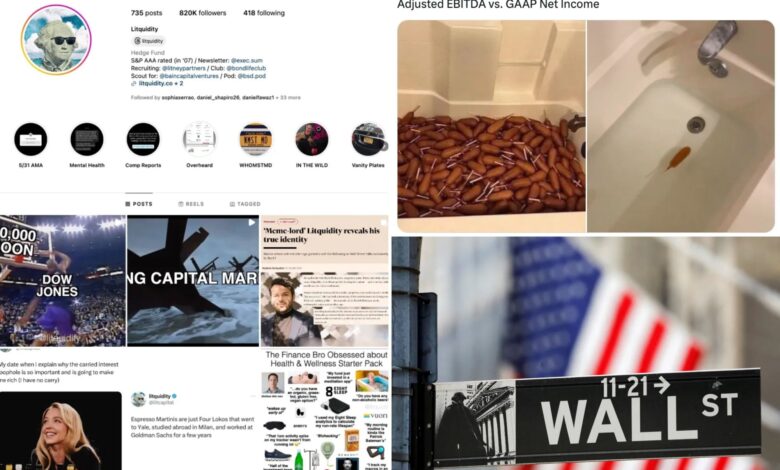

Miami-born Henry “Hank” Medina described himself as “the observer” in an office full of “loudmouths” to the Financial Times, the first outlet to report on the man behind the @Liquidity accounts — which have a collective roughly 2.2 million followers between Instagram and X.

FT described Medina as “soft-spoken, polite — the opposite of his Patrick Bateman-meets-enthusiastic junior analyst alter-ego.”

As Litquidity, Medina was lauded among the finance sector for regularly sharing funny memes — supposedly from his office bathroom — that leaned into “finance bro” stereotypes, like when he posted about “the SF tech investment banker starter pack” that included an Equinox gym membership and Patagonia-brand sweatshirt.

There was also the occasional headline-grabbing post, including when Litquidity published a slide deck produced by 13 Goldman Sachs investment-banking analysts that described the grueling conditions of working for Goldman during the pandemic.

“The sleep deprivation, the treatment by senior bankers, the mental and physical stress…” one wrote, while another said his position at the David Solomon-run bank was “arguably worse” than his experience in foster care.

Though it was never revealed how Medina got his hands on the confidential deck, it was attributed for kicking off a fierce competition among Wall Street trying to keep junior bankers happy — like the $20,000 bonuses Credit Suisse was dishing out to all-expenses-paid vacations and free Pelotons, according to Business Insider.

At the time, Goldman had also bumped first-year analyst pay from $85,000 to $110,000 — before bonuses.

Medina told BI that the response to the Goldman presentation “put him on the map,” though he maintained his anonymity so as to not violate company policy while he held roles at Deutsche and Jeffries.

Medina launched his own finance career after graduating from Cornell University’s business school in 2013, according to FT, though colleagues knew from the start he was destined for something else.

Kevin Cullinane, a former Jefferies teammate of Medina’s who is now at Barclays, told FT Medina “was on to something even before he started the account — he was the only person in the bullpen showing me funny stuff from the internet”.

By 2016, Medina was working for Connecticut-based private equity firm Wexford Capital. In 2017, he launched the Litquidity account.

The account quickly took off. “Now, the amount of people at Barclays around the bullpen that say, ‘did you hear this latest thing from Litquidity?’ is amazing,” Cullinane told FT.

“I tell them, ‘that’s my boy from Jefferies.’”

Litquidity became so popular that by 2020 — when Medina had found himself back in Florida working for Deutsche Bank — he decided to work on the social media account full time.

By the following year, Medina hired reality TV star and fellow former investment banker Mark Moran, FT reported.

Moran was given undisclosed equity in Litquidity, which Medina estimated to be around $20 million in 2021.

The duo launched a newsletter dubbed “Exec Sum” and a podcast titled “Big Swinging Decks,” which was sponsored by cryptocurrency firm CoinFLEX and halted production when crypto crashed in July 2022.

Shortly thereafter, Moran ended his involvement in Litquidity, according to FT.

As of 2022, Medina has also joined Bain Capital Ventures as a scout.

He’s also now focused on his venture capital offshoot Litquidity Capital, FT reported, which has made more than 30 investments in early stage start-ups.

The Post has sought comment from Medina via Litquidity’s social media accounts and Bain.