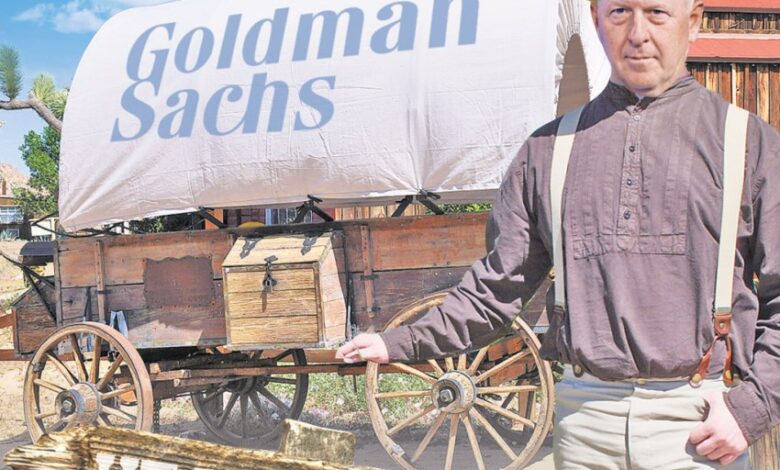

Goldman Sachs ‘gold’ panning in Utah as stock keeps rising

To hear it from his handlers at Goldman Sachs, CEO David Solomon is having quite a moment these days.

After surviving a rocky couple of years of staff turmoil and business failures (retail banking, the Apple credit card), Solly gave up his side hustle as DJ D-Sol so he could focus more on his day job, and it seems to be working.

Goldman’s stock has been up, way up, beating rivals JPMorgan and Morgan Stanley in recent months.

The firm had blow-out profits for the first quarter of this year, even as the dealmaking business remains pretty weak.

Can you imagine what might happen when things really pick up?

Solly, as expected, took a victory lap last week during the NY-based investment firm’s annual shareholder meeting — where he easily survived a shareholder vote calling on Goldman’s board to split his job and appoint a separate chairman — even if it all went down in a seemingly odd locale: Red State Utah.

Salt Lake City to be exact.

Yes, on its face, a weird place for a globalist investment bank to hold a shareholder meeting and for its globalist CEO to take a bow for a job well done (of late).

Except when you consider the business rationale behind the venue.

Goldman, like many NY-based businesses, has been moving operations from the business-unfriendly confines of the Big Apple because of high crime and taxes.

DJ D-Sol also needs to shed his image as one of Wall Street’s more “woke” CEOs with Red State America, I am told.

Goldman has more than 3,000 of its roughly 45,000 employees stationed In Utah (mostly in the capital of Salt Lake City).

The state is Goldman’s third largest employment hub — behind its NY headquarters and Texas.

And it’s not just back-office workers but also those involved in banking and technology.

Utah, in case you don’t know, has carved itself out a nice little tech sector, known as “Silicon Slopes,” for the scenic mountain ranges surrounding well-heeled towns like Park City.

Gala at gov mansion

That’s one good reason why Solomon has been ingratiating himself lately with the state’s political and business class.

The Post has learned that after the shareholder meeting Wednesday, selected members of the state’s fat-cat class received a special invite from Solomon for a private dinner Wednesday night at the governor’s mansion, a gala co-hosted by Utah Gov. Spencer Cox and DJ D-Sol himself.

A Goldman rep confirmed the dinner and Solomon’s special invite, stating that given the state’s importance to the Goldman ecosystem, it’s important to get to know Utah’s “in” group.

“Our dinner with the local community is a great tradition after all our shareholder meetings,” a spokesman for Solomon told me.

“This dinner was special because of our quarter-century relationship” with the state.

OK, but Goldman doesn’t just do business in the state, but with the state as well, my research shows.

It’s a major player in Utah’s pension-fund business, and that’s the other reason for Solly’s charm offensive.

Red States like Utah have been canceling woke firms left and right in recent years, and Goldman seems ripe for the same treatment meted out to BlackRock in places like Texas, Tennessee, Florida and, yes, Utah.

That’s probably why high up on the invite list for Solly’s dinner was Utah GOP State Treasurer Marlo Oaks.

Oaks didn’t comment for this column, but he has emerged as a leading critic of woke capitalism and Environmental Social Governance (ESG).

He has yet to target Goldman in his efforts, but he has barred BlackRock from doing business with the state’s pension fund — and people who know him say he’s fully aware of Goldman’s and Solomon’s woke reputation.

A Goldman rep had no comment on how the dinner went or if Solly was able to make nice with Oaks.

If he tried, my guess is he would have a tough sell.

As I point out in my upcoming book on progressive politics in the boardroom, “Go Woke, Go Broke,” under DJ D-Sol, progressive ideology has flourished at Goldman.

Goldman has embraced controversial Diversity, Equity and Inclusion mandates that heavily weigh gender and race in hiring decisions.

There is a Goldman “pronoun guide” on its website, encouraging employees to bring their “Authentic Self to Work.”

The firm is a proponent of ESG, the progressive investment technique that seeks to force companies that are held by Goldman’s investment arm to divest from oil and gas exploration, and embrace endless diversity measures.

ESG strategies, Goldman says on its website, “can be important tools for identifying investment risk and capturing opportunities on behalf of our clients.”

Yet it leaves out its own research that shows ESG crushing energy investment and leading to inflation.

Goldman’s ESG-inspired policy includes not underwriting IPOs of companies that don’t have gender diverse board members.

Like most things woke, Goldman’s practices are hypocritical and silly.

The company has no problem doing deals for Chinese companies that have Communist Party apparatchiks on their board and no members of the oppressed Uyghur minority of any gender.

So, you can see why Solly is turning up the charm in Utah and elsewhere in Red State America where ESG is about as popular as COVID, sources tell me.

Goldman has already found itself at odds with leaders in West Virginia after officials sought to bar the company from various forms of state business.

Solly would like to avoid the same thing from happening in Utah — given the strategic importance of the state to its business model.