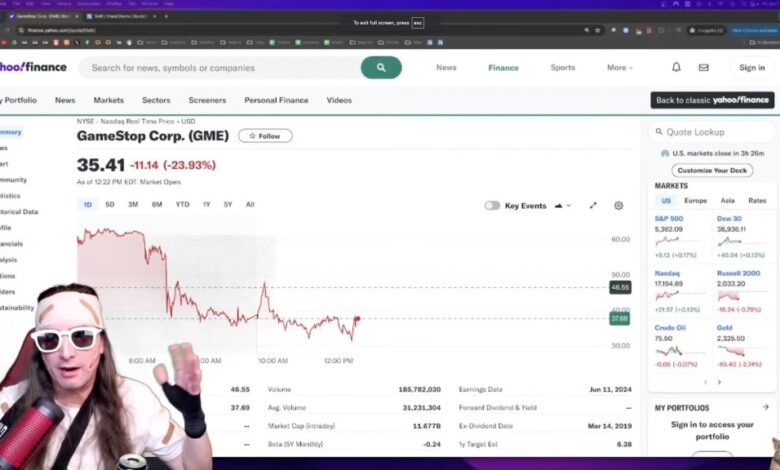

GameStop shares continue to plunge as frenzy over Roaring Kitty’s return fizzles

Shares of GameStop tumbled for a second consecutive session on Monday, extending deep losses after stock influencer Keith Gill’s return to YouTube last week failed to spark fresh investor enthusiasm for the struggling shopping mall retailer.

Gill, known on YouTube as “Roaring Kitty,” held his first livestream in three years on Friday, the day GameStop unveiled its second share sale in days.

A key figure behind an eye-popping rally in GameStop in 2021, Gill joked about memes and interspersed his discussion of GameStop with several disclaimers in a livestream that by Monday had over 2.4 million views on YouTube.

On Monday, GameStop shares sank about 15% to $24.06, following a dive of nearly 40% on Friday after the company reported a drop in quarterly sales.

Also on Friday, GameStop said it would sell up to 75 million shares, days after it made $933 million by selling 45 million shares.

Gill acquired 5 million shares of GameStop at an average price of $21.274, according to details he shared on social media. In addition, he bought 120,000 GameStop June 21 call options at a strike price of $20 at $5.6754 per contract. Reuters was unable to verify the size and value of his holdings.

On Monday afternoon, the options contracts were changing hands at $6.40 a contract, according to LSEG data.

Other so-called meme stocks also gave back recent gains on Monday, with AMC Entertainment losing nearly 7% and headphone seller Koss down about 4%.

Shares of GameStop nearly tripled in value over two days through May 14 after an account associated with Gill returned to X.com, formerly called Twitter.

Since then, GameStop shares have given up most of those gains, and the stock remains up about 37% so far in 2024.

The videogame retailer has been losing money for years as customers shift to online purchases, and its latest quarter was no different.