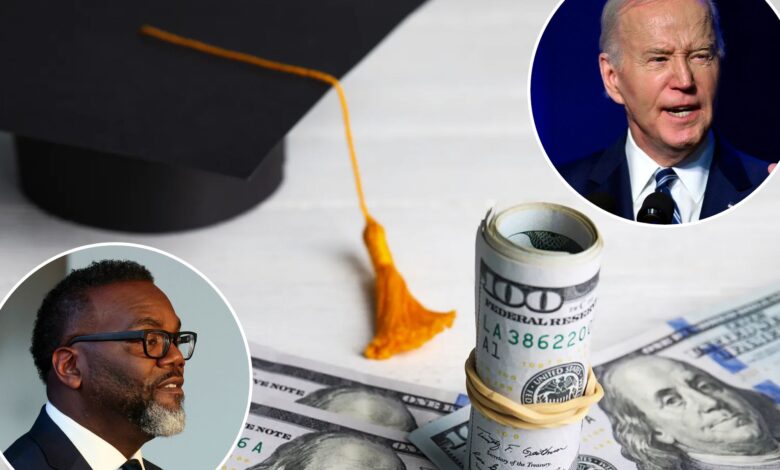

Fixing student debt will take more the Biden forgiveness

President Biden vowed to fix the student loan system and now is in a mad rush to forgive as much debt as possible before the November election.

The White House recently canceled another $7.4 billion in student loans for over 277,000 borrowers.

That brings the total to nearly $153 billion in federal student loans wiped away for almost 4.3 million Americans.

This latest move cancels debt for folks whose balances have increased beyond what they initially borrowed.

But none of Biden’s actions prevent students from taking on new debt in the first place.

Because at the heart of America’s problem is unconstrained college costs and an education system that doesn’t properly prepare students for advanced learning.

Around 43 million people owe nearly $1.6 trillion in federal student loan debt.

Fueling these numbers are college costs, which have risen 1,200% since 1980, astronomically higher than the cost of living and goods, which is up 236%.

That’s led to a roughly 750% increase in student loan debt from 1995 to 2022, according to the Congressional Budget Office.

Studies point to college debt and local property taxes as the two biggest factors leading to the decline of the US middle class. While college graduates’ lifetime earnings far exceed those who have not graduated, much of those earnings are offset by student debt.

That impacts their ability to save, buy homes and invest in their own children’s futures.

The US government will continue to issue loans to help Americans afford college, meaning colleges will continue to raise their prices, forcing Americans to take out even more loans.

Compounding all of this is a national K-12 system failing to adequately prepare students to even enter college.

And low-income and minority students are being disproportionately hurt most.

In Chicago Public Schools, for instance, reading proficiency among 11th graders was 22% in 2023, but the district still graduated 83% of its class.

Those who manage to leave college with a degree are usually saddled with loans. Many are forced to drop out — and they, too, leave with loans.

In fact, the bulk of student loan debt is driven by individuals who dropped out before they completed their degrees.

Among Black students, the six-year college graduation rate is just 40%, compared with 64% of white students and 54% of Hispanic students.

Meanwhile, among 2016 graduates, roughly 40% of Black students left college with $30,000 or more in debt, compared with 29% of white students, 23% of Hispanic students, and 18% of Asian students, according to PBS NewsHour.

It’s clear elementary and secondary schools are not preparing students to complete a university degree.

But instead of helping close the gap, supporters of student loan forgiveness are often critics of K-12 school choice — even though school choice most benefits low-income and minority families. Chief among those critics are teachers unions.

National teachers’ unions and their local counterparts have been unrelenting in anti-school choice measures.

They have engaged in lobbying and media campaigns to discredit school choice by inaccurately claiming it siphons money from public education.

The Chicago Teachers Union, for instance, has fought and lobbied against any kind of educational choice for families.

They were the chief supporters of the closing of Illinois’ only school choice program in 2023 — a tax credit scholarship program.

Now, through their former union lobbyist turned mayor — Brandon Johnson — they are working towards the elimination of selective enrollment and magnet schools, which see higher proficiency rates than other Chicago Public Schools. As a result, we are failing Black, brown and low-income families with our current system.

Ending this cycle can be addressed by first permanently capping the annual loan repayment to a fixed percentage of income, capping interest on federal student loans and canceling debt after a fixed number of years.

But this must also be accompanied by serious limits on higher education costs.

More long term, America must look to end the practice of appeasing teachers’ unions who put politics over educating students.

This means adequately preparing our students for higher education and adopting widespread school choice so families — not special interests — can select the best public or private schools for America’s children.

Paul Vallas is a policy adviser to the Illinois Policy Institute, was the first CEO of Chicago Public Schools and has 18 years of experience leading large city school districts in Philadelphia, New Orleans and Bridgeport, Conn.