Daily Journal says Charlie Munger’s death will hurt $300M stock portfolio

A small California publishing company that was owned by famed investor Charlie Munger warned its shareholders that his death would have a significant impact on the company’s $300 million stock portfolio.

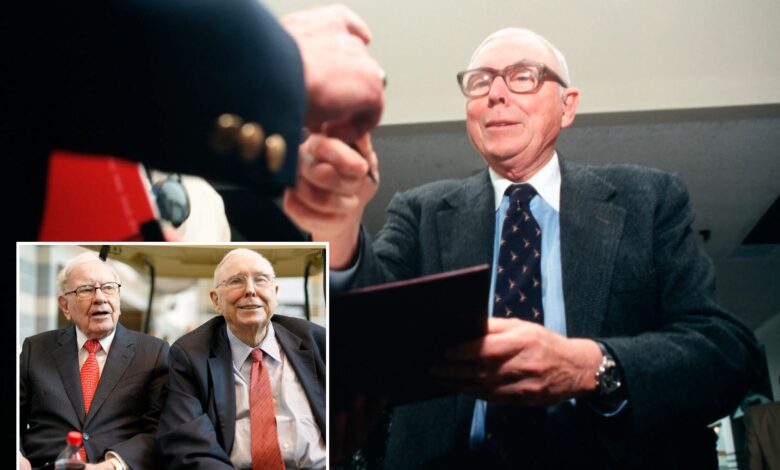

Munger — who died last month at age 99 after serving as Warren Buffett’s long-time lieutenant at Berkshire Hathaway — had been chairman of the Daily Journal Corporation for about 45 years.

“Although the Board will work to ensure that the portfolio remains well-managed, it’s impossible to ever replace Mr. Munger,” the Daily Journal Corporation wrote in a Securities and Exchange Commission filing on Wednesday, Business Insider reported.

“Given the loss of Mr. Munger, the Company does not expect the future financial performance of its marketable securities portfolio to rival its past performance,” the company added in the SEC filing.

As of Sept. 30 this year — one month before his death — the value of the publisher’s stockholdings was $303 million, including $138 million in unrealized gains, per Insider.

Its stock price is up nearly 33% year to date, to $351.10.

Representatives for the Daily Journal Corporation did not immediately respond to The Post’s request for comment.

Munger purchased the Los Angeles-based newspaper in 1977 for $2.5 million through a series of acquisitions, becoming one of its largest shareholders, according to Yahoo Finance.

The paper, which has always put an emphasis on the legal market, was a great fit for Munger, a Harvard-trained lawyer before becoming a moneyman known for his vast knowledge and patient, buy-and-hold approach.

By the late ’80s, Munger had pushed the business through an acquisition spree, during which it scooped up 18 newspapers, including the San Francisco Daily Journal, The Record Reporter in Phoenix, as well as its flagship Los Angeles Daily Journal and fellow LA-based broadsheet, Daily Commerce, among others.

At the height of the financial crisis in 2008, Munger made the risky move of diversifying the publisher’s excess cash into securities, Yahoo reported.

At one point, the Daily Journal bought shares of Tesla’s Chinese electric-vehicle rival BYD, which it cashed out in late 2021 for $50 million, realizing a 15-fold return on a $3.3 million investment, according to Insider.

Over the years, Munger also spearheaded the Daily Journal’s shares in Bank of America and Wells Fargo.