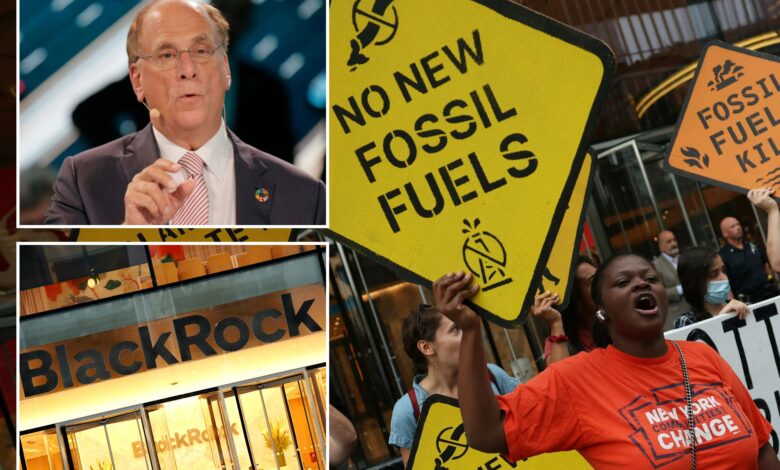

BlackRock support for ESG shareholder resolutions hits fresh low

BlackRock, the world’s biggest asset manager, cut its support for shareholder proposals linked to environmental and social issues to a fresh low of 4.1% in the most recent annual general meeting season, it said Wednesday.

Despite the number of environmental and social-related proposals increasing year on year to 493 from 455, BlackRock said most had been rejected for much the same reasons as in previous years.

In 2023 it supported 6.7% of such proposals, down sharply from its support for 47% of resolutions in 2020-21, though the number of resolutions filed with companies since that high water mark had risen sharply.

“In our assessment, the majority of these (proposals) were over-reaching, lacked economic merit, or sought outcomes that were unlikely to promote long-term shareholder value,” said its “2024 Global Voting Spotlight” report.

“A significant percentage were focused on business risks that companies already had processes in place to address, making them redundant.”

BlackRock’s handling of these and governance-related issues, together dubbed ESG, has faced fierce criticism in recent years from a group of Republican politicians, who have accused various companies of engaging in “woke capitalism.”

Against that backdrop, and ahead of the next AGM season, BlackRock had said it would push boards on their financial resilience, but that a company’s success would also depend on how it handled issues such as the world’s transition to a low-carbon economy.

Sustainability risks

The drop in support may appear to be “marginal,” said Lindsey Stewart, director of investment stewardship research at industry tracker Morningstar Sustainalytics, “but it means the firm supported 10 fewer E&S proposals this year compared with the last, despite the number of resolutions rising.”

Also driving the number lower were the growing number of resolutions aimed at forcing companies to roll back their plans to manage sustainability risks, including retooling their operations to be in line with global climate goals.

BlackRock said it did not support any of the 88 proposals that fell into this category.

In total this year it supported 20 proposals.

Of them, four were related to climate and natural capital, concerning disclosures at Berkshire Hathaway, Denny’s Corp., Jack in the Box and Wingstop.

More broadly, BlackRock’s support for shareholder resolutions increased to 11% from 9% — or 99 out of 867 against 71 out of 811 in the prior year — driven by the firm’s backing for more governance-related resolutions.

“The proposals we supported sought to enhance minority shareholders’ rights, for example, by introducing simple majority voting. Market support for governance proposals also increased relative to last year,” it said.