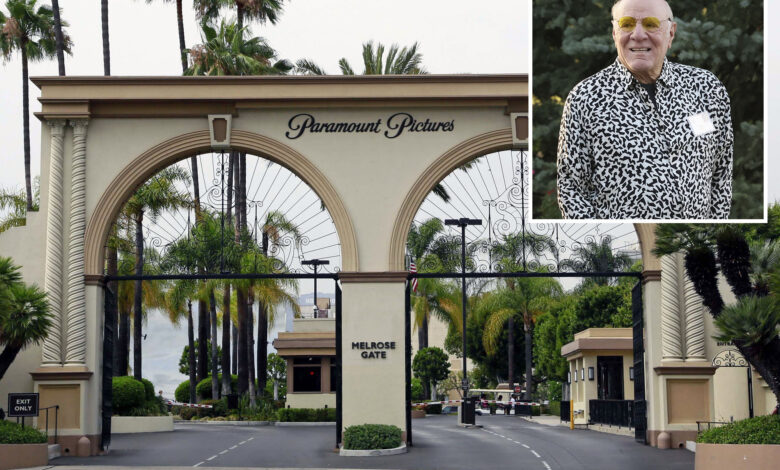

Barry Diller hints IAC no longer in race for Paramount deal: report

Media mogul Barry Diller hinted on Friday that his company IAC was no longer in the race to buy Paramount Global, CNBC reported on Friday.

The chairman and senior executive of the New York based digital-media conglomerate – which owns brands including Dotdash-Meredith, Care.com and The Daily Beast – said it is “hard to predict, but think it’s over for us,” during a CNBC interview.

Diller was reportedly in pursuit of Paramount as the struggling entertainment giant held off-again, on-again talks with tech heir David Ellison’s Skydance Media about a merger.

The two sides reached a deal in early July that would allow Skydance to acquire Shari Redstone’s family holding company, National Amusements, which owns a controlling stake in Paramount, for $1.75 billion.

The agreement had a “45-day go shop” period that allows Paramount to seek any better offers.

Diller’s comments signal he is no longer be a suitor.

The billionaire said he would be “shocked” if the merger doesn’t face a huge amount of legal challenges.

Already, a Paramount Global investor has sued to block the merger, claiming the deal would cost shareholders $1.65 billion.

The lawsuit, filed by Scott Baker, alleges the merger’s primary purpose is to cash out Paramount chairwoman Redstone’s investment at a premium – while other shareholders will receive smaller payouts.

The lawsuit – filed Wednesday – calls the potential merger “unfair.” The upset suggests more legal challenges from frustrated investors may be incoming.

The Paramount-Skydance deal leaves Paramount with 45 days to find a better offer. If the media giant finds a better offer that Skydance is unwilling to match, it must pay Skydance a $400 million back-out fee.

Meanwhile, Mario Gabelli of Gabelli Asset Management Company Investors reportedly sought more details about the valuation of National Amusements assets — suggesting the billionaire may challenge the Skydance deal.

Gabelli’s investment firm sent a letter in early July to Paramount’s general counsel requesting more information, a source at Gabelli told Reuters.