Apple stock rallies after record-setting $110B stock buyback

Shares of Apple climbed 6% Friday after the iPhone maker announced a record-setting buyback program on the heels of second-quarter earnings topped Wall Street’s estimates.

Apple announced Thursday that its board authorized $110 billion in share repurchases, a 22% increase over last year’s $90 billion authorization, Bloomberg earlier reported.

The move marks the largest buyback value ever announced in US history.

In 2018, Apple came close to the new record when it authorized $100 billion in share repurchases, according to Bloomberg, citing data compiled by market research firm Birinyi Associates that goes back to 1999.

Apple also said that its revenue for the three-month period ended on March 30 rang in at $90.8 billion. Though it was a 4.3% drop from the year-ago period, it topped the $90.3 billion analysts had anticipated.

The results came as a relief to investors, Bloomberg reported, as Apple has posted sales declines in the past five out of six quarters in the face of a tough smartphone market in China.

Last month, Apple was overtaken by Samsung as the world’s No.1 phone maker, according to the latest data from research firm IDC.

Following the earnings report, shares of Apple climbed 7% in extended trading Thursday. Shares closed at $183.36 on Friday.

Apple did not provide formal guidance for the rest of its fiscal 2024, but on an earnings call with analysts, finance chief Luca Maestri said the company expected the current quarter will deliver double-digit year-over-year percentage growth in iPad sales.

The Services division is also forecast to continue growing, Maetstri said, which includes subscriptions, warranties, licensing fees and Apple Pay features.

In addition, Apple reported reported net income of $23.64 billion, or $1.53 per share — down 2% from $24.16 billion, or $1.52 per share, in the year-ago period.

The iPhone’s slumping sales played a part in the decline.

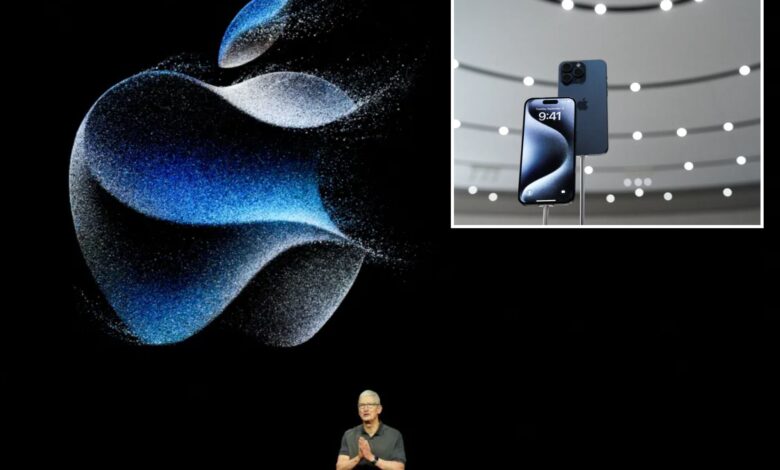

Apple chief Tim Cook told CNBC that sales in the fiscal second quarter suffered from a difficult comparison to 2023, when the company realized $5 billion in delayed iPhone 14 sales from COVID-induced supply issues.

“If you remove that $5 billion from last year’s results, we would have grown this quarter on a year-over-year basis,” Cook said, per CNBC. “And so that’s how we look at it internally from how the company is performing.”

Apple said iPhone sales fell nearly 10%, to $45.96 billion, suggesting that there’s weak demand for the latest iPhone, the 15 Pro and Pro Max models, which were released in September.

Sales of other Apple products, including its Apple Watch and AirPods headphones, also dropped 10% year-over-year, to $7.9 billion.

The decline didn’t come as a surprise to analysts.

Mac sales, meanwhile, were up 4%, to $7.45 billion. Cook attributed the growth to the upgraded M3 chip placed in the company’s new MacBook Air models as of March.

With the new chip, Apple’s coveted Mac laptops promise to offer sharper 1080p webcams, support for faster Wi-Fi networks and up to 18 hours of battery life, according to CNBC.

Though the actual laptop design remains the same as earlier models, the new M3 chip also allows users to add up to two external displays — an improvement from a single screen. However, the lid of the laptop has to remain closed to support two screens, otherwise just one will work.