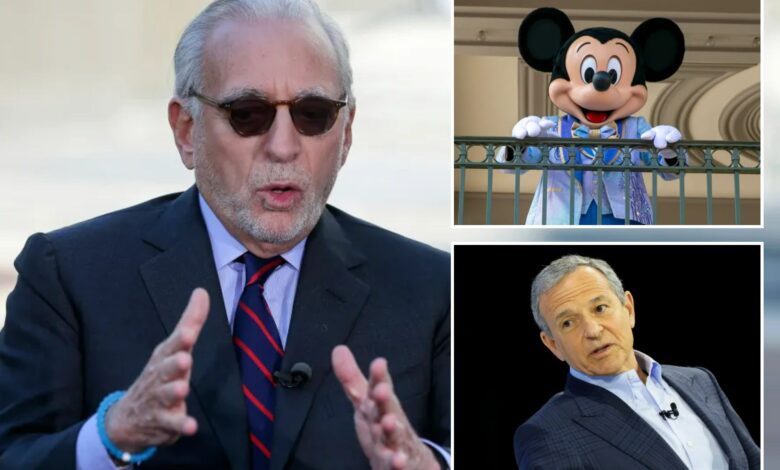

$3B Disney bet caused Nelson Peltz’s hedge fund to underperform in 2023: source

A $3 billion bet on Walt Disney by Nelson Peltz’s Trian Fund Management was largely responsible for the investment management firm’s underperformance last year compared to its activist hedge fund peers, according to financial details provided to Reuters by a Trian investor.

The previously unreported details illustrate the high financial stakes for Trian as it seeks to shake up Disney’s board in this year’s highest-profile proxy contest.

Trian’s fund returned 10% last year, according to the investor, half the 20% return on average that activist hedge funds scored based on data compiled by Hedge Fund Research.

Trian’s position in Disney, which accounted for roughly 40% of its total portfolio at the end of the third quarter, was a major contributor to the underperformance.

Disney’s shares ended 2023 up 4%, while the S&P 500 index rose 24%.

A Trian spokesperson declined to comment.

Trian amassed a Disney stake at the end of 2022 and threatened the company with a board challenge in January 2023, criticizing it over losses in its streaming business, poor corporate governance and its succession plan.

Peltz, Trian’s CEO, dropped the board fight in February 2023 after Disney announced an extensive restructuring program that included cost cuts and 7,000 layoffs.

“Now Disney plans to do everything we wanted them to do,” Peltz said at the time.

But as Disney’s shares languished for most of 2023, Trian changed its stance.

It increased its ownership fivefold to roughly 2% of the company and accused Disney CEO Bob Iger and the company’s board of failing to deliver on its promised turnaround.

Last month, Trian said it would nominate Peltz and former Disney chief financial officer Jay Rasulo to Disney’s board.

The entertainment giant has urged its shareholders to oppose the move, arguing Trian’s candidates would be disruptive to its board.

A shareholder vote on the nominations is expected to take place in the spring unless a compromise is reached.

ValueAct Capital, another activist hedge fund and Disney shareholder which, unlike Trian, has been supportive of Disney’s board, returned 39% last year, Reuters has reported. ValueAct bought its Disney shares later in 2023, long after Trian established its stake, when the stock was closer to its recent lows.

The value of Trian’s stake in fast-food chain Wendy’s, where Peltz sits on the board, dropped 15% in 2023.

To be sure, Trian also enjoyed wins last year. Its portfolio was lifted by double-digit gains in plumbing parts distributor Ferguson and asset manager Janus Henderson Group.

Trian said a year ago that companies in which it had invested had outperformed the S&P 500 in total returns by an average 9% annually while Peltz served on their boards. It has not provided a more up-to-date figure.