Why Boeing is trying to sell off assets

Boeing is exploring asset sales in a bid to boost its fragile finances by shedding its non-core or underperforming units, the Wall Street Journal reported on Sunday.

The planemaker last week reached an agreement to offload a small defense unit that makes surveillance equipment for the U.S. military, the paper reported, citing people familiar with the deal.

Boeing has lurched from crisis to crisis this year, ever since Jan. 5 when a door panel blew off a 737 MAX jet in mid-air.

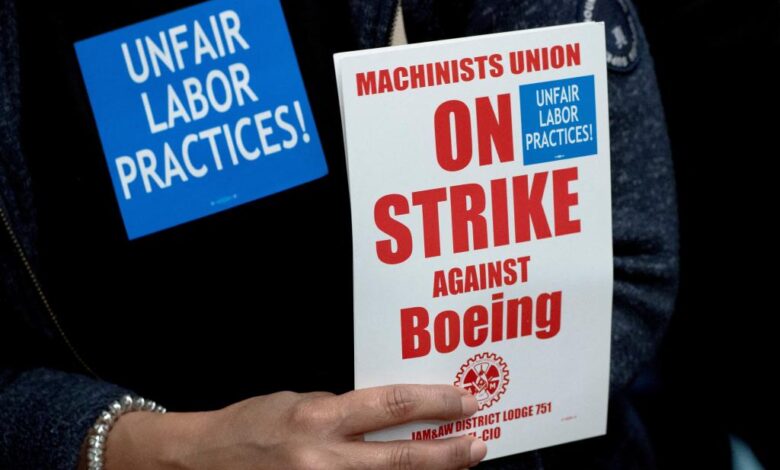

Since then, its CEO has departed, its production has been slowed as regulators investigate its safety culture, and in September, 33,000 union workers went on strike.

The Journal reported that in recent financial-performance meetings, new CEO Kelly Ortberg asked the heads of the company’s units to lay out the value of those units to the company.

Boeing’s board recently met to discuss the next steps for the company, where directors questioned division heads and combed through reports to examine the state of each unit, the report said.

Boeing declined to comment on the report.

Striking machinists at the planemaker are set to vote Wednesday on a new contract proposal that includes a 35% pay hike over four years.

The work stoppage has halted production of the planemaker’s best-selling 737 MAX and its 767 and 777 widebodies, putting added pressure on its already weak finances.

Earlier this month, Boeing announced it would cut 17,000 jobs, or 10% of its global staff, and take $5 billion in charges.